Question:

What is the difference between the senior exemption and the senior freeze?

Answer:

The senior exemption and the senior freeze are deductions off of a senior citizen’s real estate tax bill. Here’s how these exemptions work and some of the differences between them.

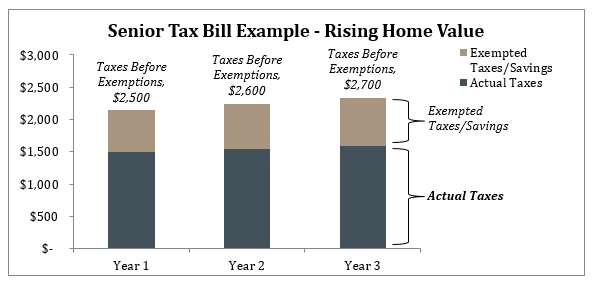

Real estate taxes are based on the current assessed value of the home. As the value of the home rises, the taxes also rise.

Qualifying seniors receive deductions off their tax bills because they are senior citizens. The senior citizen exemption reduces the tax bill by a sum certain each year. The actual deduction is $5,000 times the local tax rate. So, if the local tax rate is 6%, the senior citizen exemption will be $300.

The goal of senior freeze is to lock the taxable value of the senior’s home.

As the senior’s home value rises, its taxes will also rise. But, senior freeze recipients receive a deduction off their tax bills for the freeze. The senior freeze deduction is an amount large enough so the final tax bill (after the senior freeze exemption) is based on the frozen value and not the current — and higher — assessed value. As a result of the senior freeze, qualifying seniors enjoy a much lower tax bill.