Question:

You filed an appeal on my property and the assessment was reduced, buy my tax bill is higher than last year. Where are the savings?

Answer:

When your assessment is reduced because of a tax appeal, your taxes before exemptions will always be less than what they would have been had there been no reduction. You cannot see the savings by comparing this year’s bill to last year’s bill. You see the savings by comparing this year’s bill to the bill you would have received had your assessment not been reduced.

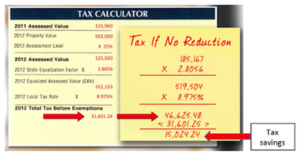

Your taxes are determined by the: assessed value, state equalization factor, and local tax rate.

Months before you received your bill, the Assessor placed an assessment on your property. In a reassessment year, an assessment notice was mailed to you.

You contested that assessment and caused it to be reduced. The reduced assessment appeared on your tax bill and was used to compute your taxes.

But, since you won your appeal, you never saw the bill that would have been issued had the original assessment not be lowered.

The bill you received included the reduced assessment and not the original Here’s what an actual tax bill looks like and what the bill would have looked like had there been no assessment reduction.

As you can see, the actual tax was lower than the tax that would have been billed had no reduction been obtained. That’s the savings.

There are several factors that could have caused this year’s real estate tax bill to be greater than last year’s.

- Equalizers and tax rates vary from year to year but tend to increase over time.

- This year’s equalization factor may have been higher than last year’s.

- This year’s tax rate could have been higher than last year’s.

- Even if there was an assessment reduction, this year’s assessment may have been higher than last year’s assessment.

The tax savings that you realize because of an assessment appeal is the difference between the actual taxes billed and the taxes that would have been billed had no reduction been obtained. It is not the difference between this year’s taxes and last year’s taxes.