Question:

In Cook County, how does the assessment process work?

Answer:

In Illinois, real estate is taxed on is its market value. The higher the market value, the higher the tax. And, the lower the market value, the lower the tax.

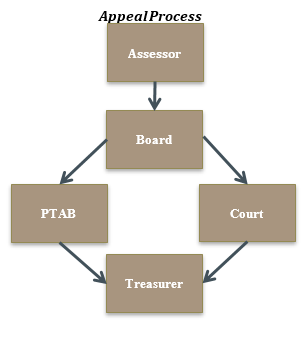

The process begins with the Assessor valuing property for tax purposes. That value is called the assessment.

Taxpayers have the right to contest their assessment by filing a tax appeal. If a taxpayer wins his appeal, the tax bill he receives in the future will be smaller then the bill he would have received had no appeal been filed. If the tax bill was already paid, the taxpayer will receive a tax refund.

In Cook County, property is reassessed at least once every third year. This is called triennial re-assessment. Chicago is assessed one year, the north suburbs the following year, and the south suburbs the next year. The process then repeats itself.

In most cases, an assessment reduction will remain for all three years of the assessment period. But, if the property experienced an unusual event, like high vacancy or abnormally low rental income, a reduction will be awarded for one year only.

In a re-assessment year, the Assessor will mail a notice to the taxpayer indicating what he proposes the new assessment to be. The taxpayer will then have thirty days to contest that assessment by filing an appeal with the Assessor.

In a non-reassessment year, the taxpayer will only receive an assessment notice if the Assessor proposes to increase the assessment. However, the taxpayer may contest their assessment every year, even if the Assessor does not increase it.

The Assessor usually renders decisions on appeals filed to him within about 60 to 90 days after the appeal has been filed.

After the Assessor renders his decision, the taxpayer will have a second opportunity to appeal, this time to the Board of Review of Cook County. The Board generally takes about 90 to 120 days to conduct hearings and render decisions on appeals filed to the Board.

After the Board of Review renders its decision, the taxpayer will have a final opportunity to file an appeal to either (1) the Property Tax Appeal Board (PTAB), or (2) the Circuit Court of Cook County. Successful appeals to the Assessor or Board of Review will cause the next 2nd installment tax bill (before exemptions) to be smaller than it would have been had no appeal been filed.

Appeals to the PTAB or Court are always resolved after the tax bill is issued. As a result, if you win those appeals, you will receive a tax refund.