Question:

I have the senior freeze and I don’t think the Association’s tax appeal benefitted me. Please explain if it did.

Answer:

An Association tax appeal can benefit senior freeze recipients. Here’s how the freeze works and how it may benefit you.

Real estate taxes are based on property values. The higher the value of your home, the higher your tax.

If you are a Senior Freeze recipient, as your home value rises, the Senior Freeze locks its taxable value saving you money.

Even though you are a senior freeze recipient, your taxes are based on your current assessed value.

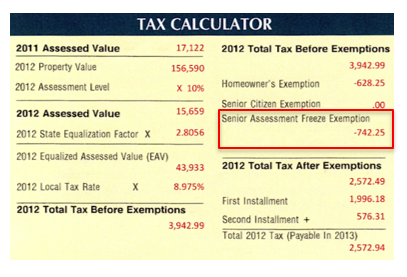

But, you will receive a deduction on your tax bill for the Senior Freeze Exemption.

This exemption reduces your final taxes so they are based on your frozen value and not your current assessed value.

In many cases, you will not directly benefit from an association tax appeal while you receive the freeze.

But, there are a few instances where you might …

- If the association appeal reduces your assessment below your previously frozen base, you will save money because of the association appeal for years to come.

- An association appeal will reduce your assessed value and your taxes before exemptions. This will benefit you when you sell your home because buyers are interested in knowing what the taxes will be when they purchase the home and the freeze no longer applies.

- While you may receive the freeze this year, you may not be eligible in future years. And, the association’s appeal will save you money when you no longer obtain the freeze.

Property values for all homeowners – seniors included – are positively impacted from keeping taxes in your development low.