Question:

Outside of Cook County, how long does the appeal process take?

Answer:

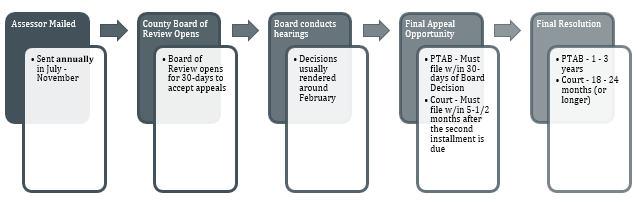

There are several places where a taxpayer outside of Cook County can appeal its taxes. Each has its own rules and timing. Here is a summary of the process and how long it can take.

Each year, your local Assessor will adjust the assessment of all properties in your township and will send each owner a notice of re-assessment.

Assessment notices are mailed sometime between July and November of each year. Then, your County Board of Review will open your township for 30-days allowing taxpayers to file appeals.

The Board will conduct hearings, consider the evidence submitted to them and decide all appeals. They typically render their decisions in February of each year.

Taxpayers then have one final appeal opportunity. They can file an appeal to either the Property Tax Appeal Board or the Circuit Court of the County.

Appeals to PTAB must be filed within 30-days of the Board’s final decisions for the township.

Appeals to the Court must be filed within 75-days after the second installment tax bill is due.

Appeals to PTAB can take 1 to 3 years to resolve. Some cases are settled, and, as a result, are resolved fairly quickly — in 12 to 18 months. Others proceed to trial and take more time.

Court cases can take a year or two to resolve. Highly contested cases could take longer.